Here is a simple, but often ignored, truth: if you publish online, whether it's a news article, blog post, podcast, video, or even a user comment, you open yourself up to potential legal liability. It doesn't matter whether you are a professional journalist, hockey-mom, or an obscure blogger, if you post it, you'll need to be prepared for the legal consequences.

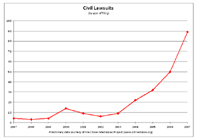

So how big are the legal risks? It depends on what you publish and how you go about doing so. If you publish a blog about cute cats, for example, your risks are going to be lower than they would be if you run a website focused on local police corruption. Over the next few weeks we'll attempt to quantify and analyze these risks by digging into our legal threats database, but even at this preliminary stage, we can say that the threats directed at online publishers have clearly been increasing. As the figure to the right shows, in the last 10 years, the number of civil lawsuits filed

against bloggers and other online publishers have increased from 4 in 1997 to

89 in 2007.

So how big are the legal risks? It depends on what you publish and how you go about doing so. If you publish a blog about cute cats, for example, your risks are going to be lower than they would be if you run a website focused on local police corruption. Over the next few weeks we'll attempt to quantify and analyze these risks by digging into our legal threats database, but even at this preliminary stage, we can say that the threats directed at online publishers have clearly been increasing. As the figure to the right shows, in the last 10 years, the number of civil lawsuits filed

against bloggers and other online publishers have increased from 4 in 1997 to

89 in 2007.

While most lawsuits never get to trial, even frivolous suits dismissed at a relatively early stage of the litigation can be expensive to defend. Unfortunately, if you lack the money to carry out a vigorous defense, your only option may be to settle (perhaps agreeing to take down the offending content or even your entire site) regardless of the merits of your defense.

For these reasons, it is important to assess whether your online activities are covered by insurance. For most non-professionals, this means your existing homeowners or renters insurance. (If your online activities are part of an existing business, you may be able to add coverage to your business insurance policy through an add-on rider.) Keep in mind, however, that most homeowners policies exclude coverage for "business pursuits." How "business pursuits" is interpreted varies from state to state. (See the Insurance Exclusions for Business Pursuits section of our legal guide for more information.) In most states, your activities may be excluded from coverage if you earn advertising income from your site or blog or you collect money through other online means.

If your activities are not covered by your existing insurance, you should give serious consideration to getting media liability insurance. Although these policies can be prohibitively expensive, a new insurance program offered by Media/Professional Insurance called "BlogInsure" is aimed specifically for bloggers and other independent online publishers.

The new insurance, which is currently available only to members of the Media Bloggers Association (MBA), provides coverage for defamation, invasion of privacy, and copyright infringement claims. Premiums start at $450 per year for $100,000/$300,000 in coverage ($100,000 per claim and $300,000 aggregate per year) and go up from there depending on how much revenue your blog or site generates and the type of content.

Bob Cox, president of the MBA, has been working tirelessly on this issue for years and deserves a great deal of credit for putting this together. He was also instrumental in getting Poynter's News University to develop an online media law course for bloggers and other online publishers. The free course, which is required for anyone seeking to enroll in the new insurance program, launched last week. (Note: I co-authored the course with Geanne Rosenberg from the City University of New York's Graduate School of Journalism).

For more on BlogInsure, see the MBA's press release here.